|

- UID

- 137770

- 帖子

- 2138

- 积分

- 12696

- 学分

- 66377 个

- 金币

- 4962 个

- 性别

- 男

- 在线时间

- 509 小时

|

【China Daily】Key index indicates rebound, easing fears

|

BEIJING - Manufacturing in China rebounded in August, easing fears of a steep correction to the economy, analysts said.

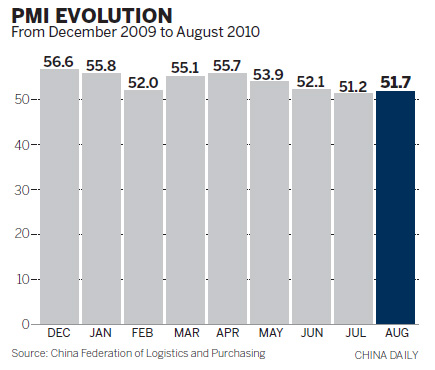

The Purchasing Managers' Index (PMI), a major indicator of economic activity, rose to 51.7 percent in August, up 0.5 percentage points from the July figure, and reversed a three-month fall in the growth rate, the China Federation of Logistics and Purchasing said on Wednesday.

Workers assemble cars in a Chery Auto plant in Anhui, September 1, 2010. China's passenger car sales in August increased 59.26 percent from one year earlier to 977,300 units. [Photo/Xinhua]

The index considers 50 to be a benchmark figure and the dividing line between economic expansion and contraction. Anything above 50 indicates expansion.

Economists have been concerned about a slowdown, especially when US growth dropped to 1.6 percent in the second quarter, from a previous estimate of 2.4 percent in July.

Neither is news on the job front in the European Union good with the unemployment rate hitting an almost two-decade high.

A research note from the Industrial Securities said the rebound showed domestic demand is playing an increasingly important role, with the nation relying less on foreign trade for growth.

"China's recovery in the third quarter is helping prevent the world from a double dip recession," the note said.

Zhang Liqun, a researcher at the State Council's Development and Research Center, said he believed the PMI rebound indicated that China's economy was not likely to see a steep correction.

"But attention should be paid to the big rebound in the Input Price Index (IPI), which might increase pressure on companies' costs."

The IPI jumped 10.1 points last month to 60.5.

Key index indicates rebound, easing fears

"Overall, the leading indicators in August point to some near-term strength in manufacturing activity and a rebound in input cost pressures," said Peter Redward, head of Emerging Asia Research at Barclays Capital.

"Looking ahead, we expect a further pickup in the headline PMI in September before moderating in October."

However, Lu Zhengwei, chief economist of Industrial Bank, said he believed the rebound was largely due to seasonal factors.

Historically, the PMI tended to rise month-on-month from August to September, after declining from May to July.

"Without seasonal factors, the rebound is quite weak and should not be regarded as a signal for economic recovery," Lu said.

Despite the improved PMI statistics, most economists believe China's economic growth will continue to slow in the coming months.

"We expect gross domestic product (GDP) growth to slow further, bottoming at 8 to 8.5 percent year-on-year in the fourth quarter as the impact of the property tightening becomes more apparent and export growth slows," said Wang Tao, head of China Economic Research at UBS Securities.

"But the new investment programs announced this year will help push up investment and GDP growth from the first quarter of 2011, and we expect the growth to be 9.5 to 10 percent for the whole year," Wang added. |

|